geothermal tax credit extension

The Geothermal Exchange Organization and several partner organizations recently sent a letter to President-elect Biden and Vice President-elect Harris urging their support for an extension of. Federal Tax Credit The recently signed Federal Budget and Stimulus bill includes an extension of the Federal geothermal heat pump GHP tax credits through 2023.

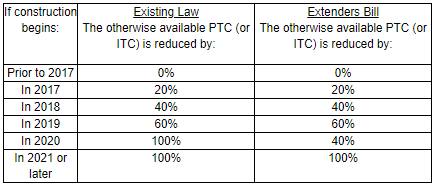

Solar Itc Extension 2022 Transect

Extension for commercial and residential geothermal heat pump GHP tax credits.

. The incentive will be lowered to 26 for systems that are installed. The extension was part of the federal governments 900 million COVID relief package passed by. In 2019 the tax credit was renewed.

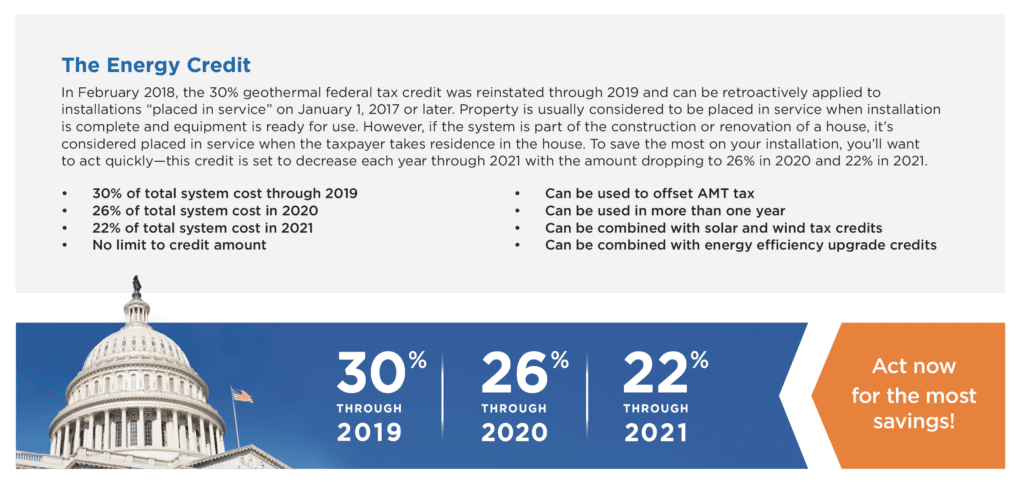

In a massive environmentally-focused year-end bill congress announced on December 21 2020 that they would extend its federal tax credit for residential ground source. However if the system is part of the construction or renovation of a house its considered placed in service when the taxpayer takes residence in the house. A 30 tax credit for the installation of a ground source heat pump geothermal system with no cap was enacted in 2009.

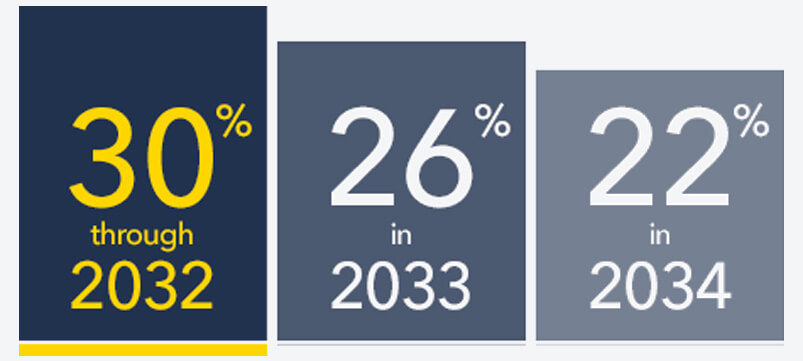

The 30 federal tax credit was extended through 2032 and will drop to 26 in 2033 and to 22 in 2034 before expiring. The new legislation lengthens the deadline for the. University of Illinois Extension in collaboration with the Illinois Geothermal Coalition is providing a webinar series this winter with expert testimony on the value.

In December 2020 the tax credit for. This Tax credit was available through the end of 2016. Tax Credits Rebates Savings.

So act now for the most savings. Please visit the Database of State Incentives for Renewables Efficiency website DSIRE for the latest state and federal. This legislative package contains an.

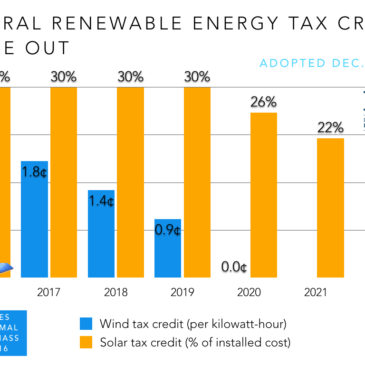

Geothermal heat pumps are similar to ordinary heat pumps but use the ground instead of outside air to provide heating air conditioning and. A 26 percent federal tax credit for geothermal installations was extended for two more years. The Illinois Geothermal Coalition is a collection of individuals from corporate non-profit and research spheres establishing geothermal energy at Illinois.

As we mentioned before the geothermal tax credit goes through cycles of reinstatement expiration and renewal within the US. A 30 federal tax credit for residential ground source heat pump installations has been extended through December 31 2032. The Energy Credit In August 2022 the.

What Federal Tax Incentives Are There For Geothermal Heat Pumps

Geothermal Heat Pump Federal Tax Credits Reinstated Eastern Illini Electric Cooperative

Geothermal Heat Pump Tax Credits Approved By Congress Geothermal Heating And Cooling Chesapeake Geosystems

Global Geothermal News Usa Nrel Two Year Geothermal Ptc Extension Will Add 200 Mw By 2018

Geothermal State Federal Tax Credits Dandelion Energy

Geothermal Tax Credit Extension Barren Washburn Sawyer County Wi

The Federal Geothermal Tax Credit Your Questions Answered

Residential Energy Tax Credit Use Eye On Housing

What Federal Tax Incentives Are There For Geothermal Heat Pumps

Geothermal Tax Credits Extended Smart Choices

Geothermal Solaire Home Comfort

Federal Tax Credits Geothermal Heat Pumps Energy Star

Congress Unveils Energy Tax Extenders Lexology

Bosch Geothermal Federal Tax Incentives By Bosch Hvac Issuu

Geothermal Blog Alpine Air Heating Air Conditioning

Federal Tax Incentives Increased Extended For Geothermal Heat Pumps Ecs Geothermal Inc

Geothermal Industry Wins Tax Credit Extension In Stimulus Bill 2020 12 31 Achr News

Inflation Reduction Act Summary Energy And Climate Provisions Bipartisan Policy Center